MONARCH VENTURES GROWTH FUND

Strategic Growth and Investment Opportunities in Southeast Asia

Monarch Ventures Growth Fund targets high-growth, AI-driven, and ESG-aligned companies in Southeast Asia—delivering predictable fixed returns, capital upside, and strategic exposure to the region’s next tech champions.

Monarch Ventures Growth Fund

Empowering Growth, Delivering Returns

Our core strategy focuses on building a diversified portfolio of scalable, tech-driven companies with strong exit potential. While Malaysia remains our primary market, we are steadily expanding across ASEAN to capture emerging regional opportunities.

The Fund is designed to provide consistent annual dividend distributions, supported by disciplined risk management and a focus on long-term capital appreciation. Through strategic capital, hands-on guidance, and regional insight, Monarch Ventures Growth Fund empowers innovation and delivers steady, attractive returns for our investors.

Experienced & Regulated Management

Our fund is managed by a regulated team under the Securities Commission Malaysia (VCMC) framework, with proven expertise in high-growth investments across Southeast Asia. We bring strategic insight, disciplined execution, and a strong commitment to investor value.

Our collaboration with Prestige Elite Group, an exclusive marketing agency, enhances our reach and impact. Prestige Elite Group specializes in promoting our investment opportunities to a select, elite audience, ensuring that our message of value and growth resonates with those who can truly benefit from it.

Investment Committee

Datuk Dr. Haji Mazlan Bin Haji Ahmad

Chairman & Portfolio Manager

Rex Fong

Regulated Fund Manager

Victor Bong

Regulated Fund Manager

Goh Keng Tat

Legal Advisor

Datuk Dr. Haji Mazlan Bin Haji Ahmad

Chairman & Portfolio Manager

Rex Fong

Regulated Fund Manager

Victor Bong

Regulated Fund Manager

Goh Keng Tat

Legal Advisor

Datuk Dr. Haji Mazlan Bin Haji Ahmad

Chairman & Portfolio Manager

Rex Fong

Regulated Fund Manager

Victor Bong

Regulated Fund Manager

Goh Keng Tat

Why Invest in Monarch Ventures Growth Fund?

Market Gap

Market volatility is a risk. Finding high-growth opportunities before IPOs is difficult.

Market Opportunity

Invest in pre-IPO companies poised for exponential growth.

Fund Manager Credentials

The managers team have successful track records in private equity and fund management.

Regulatory Assurance

Regulated by SC Malaysia and audited by SFAI Malaysia PLT for your peace of mind.

Business is not just about profit, it's about creating lasting, positive impacts that advance the human condition and drive shared prosperity.

Dato' Dr. Haji Mazlan Bin Haji Ahmad

Portfolio Manager of Monarch Venture Growth Fund

Home Address

Phone Number

Academic Qualifications

-

Doctorate in Business Administration (DBA)

Collegium Humanum, Warsaw Management University, Poland (2019) -

MBA for CEOs

University of Georgia, Netherlands (2017) -

Institute of Chartered Secretaries and Administrators (ICSA)

Institut Profesional Baitulmal (1995) -

Bachelor of Accounting (B.Acc)

International Islamic University, Malaysia (1994)

Leadership Roles

- Executive Chairman, Richwood Ventures Berhad

- Managing Director, Masyi Technologies Sdn. Bhd.

- Founder, Masyi Group of Companies

- Executive Chairman

- Finterra Group of Companies

- Executive Director, Hidayah Group of Companies

Key Expertise

- Islamic Finance & Blockchain

- Anti-Corruption Leadership

- Entrepreneurship & Advisory

Notable Achievements

- Blockchain Innovator

- Global Thought Leader

- Founder, Masyi Group of Companies

Achievements

- Founded Masyi Group of Companies, driving multi-industry initiatives across finance, manufacturing, construction, and agriculture.

- Recognized as an international speaker on Islamic social finance, blockchain technologies, and global halal industries.

- Played a key role in high-profile financial crime investigations under AMLATF at Bank Negara Malaysia.

- Provides strategic oversight as an Independent Non-Executive Director at Apex Securities Berhad.

- Contributes to education and Islamic finance governance as Ahli Lembaga Pengelola at University College Bestari and Perbadanan Wakaf Nasional Berhad.

- Supports social welfare and Islamic philanthropy as Timbalan Pengerusi Eksekutif I at YAWATIM.

Dato' Dr. Haji Mazlan Bin Haji Ahmad

Honorary Colonel (RELA), B.Acc, ICSA, FCIS, MBA, DBA

IPO-Ready & High-Growth Investments

Investing in companies with proven track records and clear exit strategies.

Targeted 10% Annual Dividend

Strategic allocation for consistent returns.

Managed by Industry Experts

Backed by a regulated fund manager with extensive private equity experience.

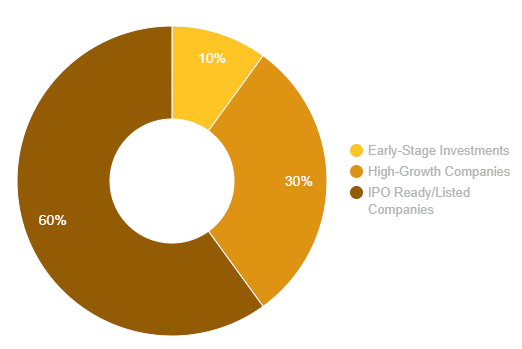

Investment Strategy

Early-Stage Investments

This segment offers exponential growth potential by investing in foundational ideas before broader market recognition.

High-Growth Companies

Our mezzanine financing provides predictable, stable returns, fueling their rapid scale while mitigating immediate equity dilution.

IPO Ready/Listed Companies

We leverage pre-IPO investment for favorable valuations and IPO placement to capitalize on market demand, ensuring stability and strong foundational returns.

Risk Management Strategy

At Vcorp Capital Management Sdn Bhd, we prioritize effective risk management to safeguard our investors and optimize our investment outcomes. Our comprehensive approach addresses key risk factors with tailored mitigation strategies:

1

Financial Risk

We use a diverse portfolio and rigorous due diligence to minimize financial risk and enhance stability.

Business Risk

Our investment criteria focus on scalability, ensuring the businesses we support can achieve sustainable growth.

2

Market Volatility

We develop exit strategies aligned with macroeconomic trends to effectively navigate market fluctuations.

3

Secure Your Investment Today

- Minimum Investment

RM 250,000

- Dividend Payout

Targeted 10% p.a (Every 6 Months)

- Fund Tenure

24 months + optional extensions

Bursa Malaysia 2025: A Thriving Year for IPOs

Strong Market Momentum in 2024

- 42 IPOs targeted for the year, driven by investor confidence.

- 21 IPOs completed (H1 2024) with RM25.7 billion market capitalization.

Leading the ASEAN IPO Market

- Bursa Malaysia ranks top in ASEAN for IPO funds raised.

- Increasing new listings highlight market resilience & investor interest.

Bursa Malaysia Aims for 60 IPOs in FY2025

Uncover the full story behind Bursa Malaysia’s strategic moves, the impact of global trade policies, and the exchange’s resilience in the face of economic challenges.

42

Targeted IPOs for 2024

21

Completed IPOs (H1 2024)

RM25.7 Bil

Total Market Capitalization

What’s Next?

As Bursa Malaysia moves further into 2025, more IPOs are expected to be launched, further strengthening Malaysia’s position as a key investment hub in the region. Investors can look forward to new opportunities in the coming months.

Frequently Asked Question (FAQ)

We invest in high-growth companies primed for IPOs, ensuring strategic exits and dividend payouts.

The Conservative Portfolio targets an annual return of 10% through a balanced investment strategy combining mezzanine financing and growth investments.

Redemptions are available at the end of each tenure period or upon mutual agreement, ensuring flexibility for investors.

Risk is managed through a stringent due diligence process, regular performance reviews, and adherence to ESG standards to maintain a strong risk-adjusted return profile.

Phone

Fund Manager

VCorp Capital Management Sdn Bhd

(Registration no. 200401002044

(640547-M))

Company

Monarch Ventures Growth Sdn Bhd

(Registration No.: 202401039965

(1585812-K))

© 2025 VCorp Capital Management Sdn Bhd | Monarch Ventures Growth Sdn Bhd. All rights reserved.